Three candidates are campaigning to unseat Delaware’s U.S. Sen. Tom Carper in the Tuesday, Nov. 6 election.

The Cape Gazette asked Carper, a Democrat, Republican Kevin Wade, Independent Alex Pires and Green Party candidate Andrew Groff about Medicare, green energy and financial reform. Answers were limited to 100 words and edited for length.

Groff did not respond to the questions.

Meet the candidates

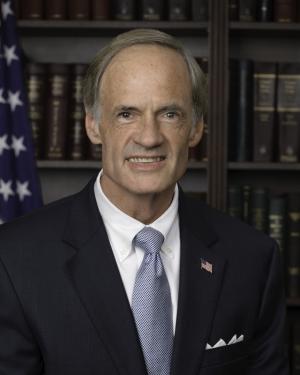

Sen. Tom Carper

Carper, 65, holds a bachelor’s degree in economics from Ohio State University and a master’s degree from University of Delaware.

A resident of Wilmington, Carper has been an elected Delaware official since 1976, including two terms as governor. Carper was first elected to the Senate in 2001, and he is seeking a third term as U.S. senator.

Carper and his wife, Martha Carper, have two sons, Chris and Ben.

Andrew Groff

Groff was born in Delaware, where he attended public school in Wilmington and later graduated from the University of Delaware, where he majored in economics and business.

Groff is a former director of production and inventory control for the Cole Haan division of Nike. He also worked for former Delaware clothing company Flapdoodles.

Groff is president of Avero Systems LLC, a computer consulting company based in Wilmington. He is also an adjunct professor at Delaware Technical Community College.

Groff and his wife, Marcia, live in Wilmington. The couple has one child, a daughter.

Alex Pires

Pires, 65, attended George Washington University Law School, and after graduating he worked for the Department of Justice.

After leaving the Justice Department, Pires started a private law practice, where he represented family farmers. He then invested his money in Delaware businesses.

As a partner of Highway One in Dewey Beach, he owns a number of local establishments, including Bottle and Cork and Rusty Rudder. He is also a founder of Community Bank of Delaware.

Pires is married to Diane Cooley, an attorney. He has two children, A.J. and Claire.

Kevin Wade

Wade, 60, began working in a Pennsylvania steel mill three days after he graduated from high school. He worked his way through University of Delaware and earned a bachelor’s degree in electrical engineering.

Thirty years ago, Wade founded Philadelphia Control Systems Inc. He continues to run the production-engineering firm today, solving assembly-line and data-automation problems for major international corporations.

Wade has been married to Gail Wade, a professor, for 35 years. The couple has one daughter and two grandchildren, who live near their home in New Castle.

Questions:

Q: Do you think privatizing Medicare would improve healthcare for senior citizens? Why or why not?

Carper: I oppose efforts that would undermine the guaranteed benefit that Medicare provides to millions of seniors. The private voucher proposals I’ve seen from my Republican friends would not keep up with medical inflation costs, meaning seniors would be left footing the bill, and do nothing to control escalating healthcare costs. Implementing the Affordable Care Act remains our best chance to improve health outcomes and reduce costs. Importantly, the legislation extends the life of the Medicare Trust Fund to 2024 and institutes reforms for seniors like closing the prescription-drug donut hole and ensuring free annual checkups and preventive screenings.

Pires: Absolutely not – I am 100 percent against the privatization of either Medicare or Social Security. The insurance companies want a voucher program because it will give them access to billions of dollars in the Medicare Trust. It is the same reason Tom Carper said in 2005, "I don't rule out at some point having private accounts," for Social Security – the banks would have access to billions in taxpayer dollars. We need to strengthen Medicare, not weaken it through privatization.

Wade: We honor our retirees. Our present retirees have made life plans that rely on the present structure and benefits of Medicare. I assure our retired seniors that their Medicare will be maintained and kept financially secure.

Our younger workers, now far from retirement, will have more flexibility to design a personalized benefit package. It will offer a menu of competing choices of healthcare support in future retirement years. This allows future retirees to customize their own plan using options from many packages to meet their own lifestyle interests. In addition, traditional Medicare will be available.

Q: Should offshore wind projects be subsidized or otherwise encouraged by the federal government? If so, how? If not, why?

Carper: I’ve been a strong supporter at both the state and federal levels for making investments in renewable, green technology that helps America end its dependence on foreign oil, creates jobs in Delaware and protects our environment. Offshore wind is one solution that can provide reliable, clean power – more than 300 coal plants worth – while also providing good-paying jobs in places like Rehoboth Beach. I believe the government has a role in supporting research and development and tax credits to incentivize offshore wind investments to help this promising industry continue to advance.

Pires: No. With all of the problems that the federal government had loaning money to private firms with untested energy sources (Solyndra) and cars that will never be built in Delaware (Fisker), they should not be involved with this. The federal government does incredible research at their alternative energy labs, and I support this. But, when the technology is right, private industry will find its own capital to make the dream of reliable and abundant wind energy a reality.

Wade: No. I am an electrical engineer, and wind power is just one way to make electricity. Unfortunately, wind power is very unreliable and expensive. Hard-working Americans should have access to all electrical generating solutions in a fair market. Let consumers pick electricity sources that make sense to them. Government should not use taxpayers’ dollars to pick winners and losers. Let suppliers compete fairly. Delawareans will benefit as producers compete for customers by lowering prices. I oppose subsidies or tax loopholes for any energy producer. Each must earn its success by providing safe and reliable energy at the lowest cost.

Q: Would you defend bank regulations contained in the Dodd-Frank Act or would you work to repeal them? Explain why.

Carper: In the wake of the worst financial crisis since the Great Depression, I supported the most comprehensive set of financial regulatory reforms since the New Deal. I continue to support that law, commonly called Dodd-Frank, to protect consumers from bad actors in the financial industry and prevent the mistakes on Wall Street from harming those of us on Main Street. We’ve taken many important steps toward implementing the new regulations in Dodd-Frank, but more work remains. Congress and federal regulators must remain diligent to ensure the mistakes of the past aren’t repeated.

Pires: The intention of Dodd-Frank was good , but the law is not working very well. Community banks and credit unions have difficulty making loans, while the big banks enjoy the ability to cherry pick the loan opportunities that used to be handled by these smaller financial institutions.

The answer to regulating banks is fairly straightforward.

1. Separate the commercial banks from the investment banks.

2. Make it easier for small, medium and community banks to lend money.

In sum, Glass-Steagall – the law that made banks choose if they want to take money from depositors or invest in securities like stocks and bonds.

Wade: Dodd-Frank should be repealed. Overbearing regulations written by people with limited experience in the industry they seek to regulate, in a one-size-fits-all mode have led to delays and denials in new business loans needed to re-grow our economy. This law, designed to reign-in large banks, forces unaffordable compliance costs on small banks serving local communities.

I favor a return to the Glass-Steagall Act that served the nation well and provided a firewall between commercial banking functions and investment risks. Mega-banks should restructure into smaller regional operations, competing to meet the needs of their communities. Community banks’ growth should be encouraged as their communities prosper.