Lawmakers to propose tax to clean Delaware's waters

Experts say they know how to fix Delaware's polluted waterways. They just don't have the money to do it.

A state task force plans to propose an income tax surcharge of up to $40 per person and a new fee on business licenses that they say would raise $20 million annually to clean up Delaware waters.

“There are lots of people who are willing to put in the work to do this, but the funding is critically needed,” said Marianne Walch, an environmental scientist at the Delaware Center for the Inland Bays.

During a recent tour highlighting places that would benefit from the tax proposal, center Executive Director Chris Bason stood near the water’s edge at Love Creek Marina and pointed out algae accumulating along the edge of the dock. The green sludge is evidence of nutrient pollution, he said, a major challenge to water quality.

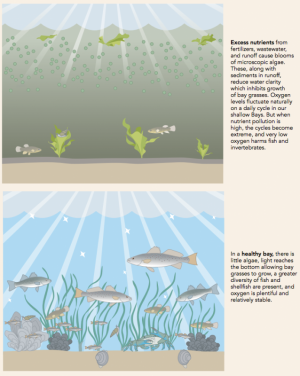

“It's too much nitrogen and phosphorous entering the water, and that causes the algal bloom,” Bason said. “It's not unique to Love Creek. It's not unique to the Inland Bays. It's a statewide problem.”

Without a dedicated source of funding for projects to reduce runoff, waterways will continue to deteriorate, he said.

“You see how brown and cloudy the water is right now?” Bason asked, pointing to the muddy creek, “That's not a natural situation. That's an algae bloom engendered by too much pollution. That's going to get worse and worse as the season goes along. It's going to use up the oxygen that's in the water, and that makes it worse for the fish.”

Reducing nutrient pollution is one reason legislators plan to propose the Clean Water for Delaware Act, asking Delawareans to shell out $40 annually and placing a $45 surcharge on business license fees to fuel a fund that would support a slew of clean water projects.

“Just thinking about the issues here in Love Creek that are not unique to this creek – the septic systems that are putting in nutrients, the agriculture inputs, all the development that's happening – there's a huge need for funding to support projects to upgrade some of the old septic systems that are failing … and to provide financial incentives to farmers for agricultural best management practices,” Walch said.

New Castle County Democrat Sen. Bryan Townsend, a co-sponsor of the legislation, said he hopes to present the bill by the end of the year.

“We know how to fix it,” Townsend said. “We just need the funding to do it.”

The state's Clean Water and Flood Abatement Task Force established in 2015 estimates the state faces a $100 million annual shortfall to clean up Delaware waterways.

“This is really meant that the new fee goes to water infrastructure projects administered by an expert group of people in a public forum,” Townsend said. “This should be an absolute no-brainer. This should be model legislation for how you administer key infrastructure decision-making.”

Some balk at tax proposal

But not everyone supports a tax increase for clean water projects.

“I'll go on the record to say I do not want any more taxes to my family,” said James “Jay” Baxter IV, a fourth-generation farmer who tends more than 2,000 acres in the Georgetown area. “My family does not need any more taxes. My business that supports families does not need any more taxes to draw funds to help clean things up.”

Baxter said legislators should look at cutting other expenses before asking Delawareans to cover the costs of cleaning the state's waterways.

“Maybe the state can learn to tighten up their belts a little bit, just like we as a private business do,” he said. “I think maybe we need to revisit where we're spending some of our money and skip the tax at this time.”

In 2014, Gov. Jack Markell proposed a clean water tax based on property taxes, which would have made large landowners pay up to $25,000.

“The Markell proposal came with sticker-shock,” Townsend said. “It would have dinged the large landowners very heavily. And the reality of farming is they're not able to absorb those costs quite so easily.”

Baxter said, as a farmer, his budget is so tight that any additional expense would be a burden.

“Regardless of how much tax it is, it's still a tax,” he said. “How many taxes disappear? That's the big question.”

But, he said, he sees where additional funding could help farmers like himself.

Baxter said he has benefited from outside funding for a wastewater reuse project with Georgetown, which required him to plant cover crops, an agricultural best management practice intended to curb nutrient pollution and improve soil health.

“We're growing more cover crops than they're able to fund because it's the best thing for this farm,” he said. “The groups that just have to complain about something, that's who needs to be taxed.”

Small investments can have a big impact

On a recent tour highlighting some of the state's most common water quality problems, Townsend and other task force representatives said the solutions aren't always complicated or expensive.

At Green Acres Farm – better known as Hopkins Farm Creamery – on Route 9 in Lewes, a relatively inexpensive fencing project has made a huge impact on water quality and livestock health.

In 2011, the farm partnered with the Delaware Center for the Inland Bays to protect 850 feet of stream from meandering cows. In 2012 and 2013, the groups installed fencing and gates around the fence to keep the cows from wading in the water.

The $23,000 project has resulted in an estimated reduction of more than 300 pounds of nitrogen annually, 15 pounds of phosphorous annually, and improved the health of the livestock.

“We want that water to be as healthy as possible. Everything we harvest off the farm, even the wildlife, we want to be healthy, obviously,” said fourth-generation farmer Burli Hopkins. “My well is the same well that the heifers are drinking from, and my kids drink that water, so it behooves us all to keep it clean.”

In the state's most recent waterway assessment, which is required by the U.S. Environmental Protection Agency every two years, scientists found most waterways do not meet federal water quality standards and are unsafe for their intended uses – fishing, swimming, recreation or supporting aquatic life – due to high bacteria levels, nutrient pollution or other contaminants, such as copper and mercury.

There are only three sites out of hundreds of locations tested statewide that are considered clean enough for all designated uses: Lower Red Mill Branch in the Broadkill River watershed in Sussex, Noxontown Pond in the Appoquinimink River watershed and Masseys Mill Pond in the Leipsic River watershed.

“The fact of the matter is we've got these issues,” Townsend said. “The issues aren't going away. They're only going to get worse, and we have got to step up as a coastal state.”

More about the proposed bill

Individuals would pay a 10 percent surcharge through their personal income tax not to exceed $40 each, and couples filing jointly would pay up to $80, according to draft legislation. Businesses applying for licenses also would pay a $45 surcharge. That money could be used for capital projects to improve wastewater infrastructure, stormwater infrastructure, water quality monitoring and programs to reduce agricultural and residential runoff.

The bill would create a Delaware Clean Water Trust overseen by a board of directors, which would combine funding from the new surcharges, the Delaware Water Pollution Control Revolving Fund, the Drinking Water State Revolving Fund and the Hazardous Substance Cleanup Fund to pay for water projects through grants, bonds and loans. Because the legislation proposes a tax, it would require 3/5 majority support from the General Assembly.

Townsend said the legislation also would expand membership of the state's Water Infrastructure Advisory Council to include farmers and other experts.

“We've gotten to a point now where the negative impacts of our shortfalls are being felt by so many people,” Townsend said. “To achieve the solution, we need the agricultural community as well.”

Draft legislation does not outline any exemptions from the personal income tax surcharge.

To review the draft legislation, click on the attachment titled “Clean Water Task Force Report and draft legislation.”