Why Mortgage Loan Program Variety Matters

Whether they’re a long-time renter looking to break the cycle or previous homeowner looking to move up or down, each homebuyer comes into the transaction with a unique situation; no two are the same. That’s why having a wide variety of mortgage loan programs for all homebuyers is a must.

As a Realtor, you are often these homebuyers’ sidekick. You’re helping them navigate through the home loan process and find their dream home. You work tirelessly to establish trust and provide solid guidance about a transaction the average person isn’t super familiar with. That’s why it’s so important to work with a mortgage lender who offers a wide range of home loan options, like Waterstone Mortgage.

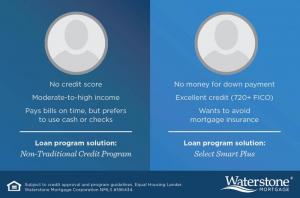

Let’s say you’re working with a homebuyer who has no credit score. They have a sufficient source of income, always pay their bills on time, but simply prefer to use cash and checks. We can help them finance their home purchase. Or perhaps your client doesn’t have much for a down payment but has an excellent credit score and would ideally like to avoid paying mortgage insurance. We can help with that, too.

Our product variety doesn’t stop there. Some of the unique options we offer include:

- 101% financing plus no mortgage insurance*

- Non-traditional credit program

- 1% down payment for eligible community heroes (teachers, paramedics, police officers, nurses, etc.)

- No down payment for eligible community experts (CPAs, actuaries, Ph.D.s, etc.)

- No down payment for medical professionals* (doctors, dentists, veterinarians)

- Single loan close construction program with just 5% down payment required

- Investment property financing

Of course, we offer the more typical loan programs, too, such as:

- Conventional loans – These are the most common type of mortgage loans. With down payment requirements ranging from 0% to 20% or more, there are options for many homebuyers.

- Jumbo loans – “Jumbo” loans are just that: a home loan offering a larger amount of funds for high-end properties and homes in high-cost areas. Jumbo loans generally accommodate any loan over the conforming loan limit. This is a great loan program choice for your clients looking to purchase a luxury home.

- FHA loans – These loans are insured by the Federal Housing Administration (FHA), providing more wiggle room for lower-income homebuyers, those with less-than-perfect credit scores, or limited down payment funds.

- VA loans – VA loans are also government-insured and are exclusive to veterans and active-duty military service members. If your client is a veteran, these loans are often the best choice as they don’t require a down payment, mortgage insurance, and have flexible credit requirements.

- USDA loans – USDA loans are a great no-down-payment option for your clients living in rural and some suburban areas. They offer better terms than FHA or conventional loans, flexible credit requirements, low mortgage insurance, and no down payment is required.

We also offer a variety of mortgage loan terms – your clients are not limited to just 15- and 3-year terms. Between our fixed-rate and adjustable-rate mortgage offerings, we can customize a program that meets their needs.

Our goal is to help individuals achieve their homeownership dreams. By offering a wide variety of loan programs, we are able to make that happen for borrowers who may experience barriers to some of the traditional loan programs but are still more than qualified to own a home.

Want to learn more about our mortgage loan variety for your homebuying clients? Find a loan originator in your area to get started.

*Geographical restrictions apply, contact a loan originator for more information.

This article is presented to you by Waterstone Mortgage. Please click here to read the full article.