There was a certain irony to the first committee meeting on recent property reassessments resulting in higher tax bills for many being held on the same day taxes were due in both Kent and Sussex counties.

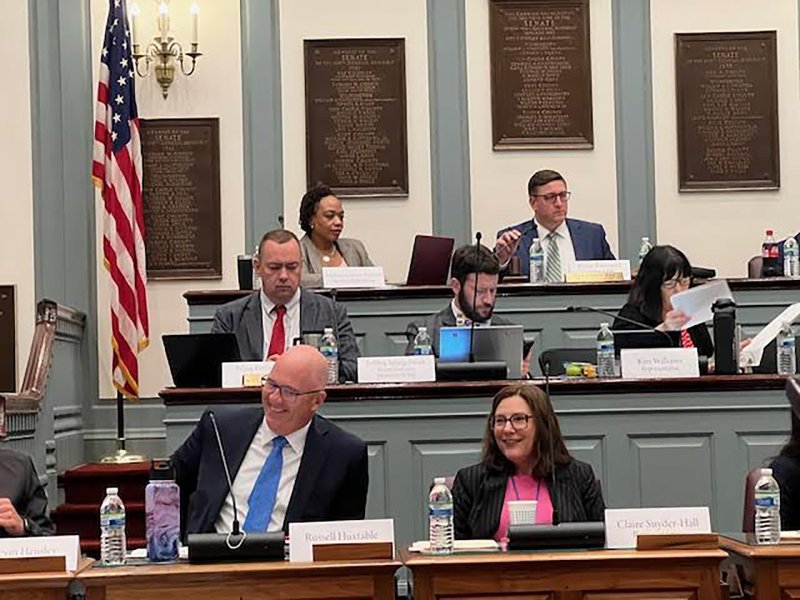

And although the tax due date in New Castle County is Nov. 30, legislators, New Castle administrators and Wilmington administrators met in Dover Sept. 30. The day mostly focused on higher upstate property taxes as legislators questioned representatives of a Texas company hired to do property reassessments in all three counties.

Again ironically, Wilmington officials testified that homes in low-income neighborhoods have shouldered steep tax increases following property reassessments by Tyler Technologies. The company was hired to reassess properties in Delaware after a Chancery Court judge ruled in favor of a 2018 NAACP lawsuit that had argued outdated property tax assessments were causing inequitable school funding and negatively affecting education for low-income students.

Cerron Cade, former Office of Management and Budget director under Gov. John Carney and now chief of staff for Wilmington Mayor Carney, said there were abnormalities in appraisals, particularly in areas where unimproved homes in Wilmington were appraised comparable to newer homes or homes that had been renovated.

“We would like to see an environment where there is a sampling of internal appraisals, especially in neighborhoods where we know for sure there have been a lot of housing projects that have occurred … so that we’re not solely using just the permitting data and comp sales, that we add this extra information to our dataset to get us closer to a fair market value,” he said.

Downstate legislators focused mostly on new, higher assessments placed on farmland.

Sen. Brian Pettyjohn, R-Georgetown, said his concern revolves around the lack of transparency with the methodology used, particularly in assessing poultry farms.

“The question is why there was so much difference in poultry farm valuations in Kent County over Sussex,” he said.

Pettyjohn said he met with poultry farmers and members of Tyler Technologies a year ago about the methodology used to determine poultry farm values, and they left with no information.

“Tyler Technologies was unwilling to share the specific methodologies that were used to develop valuations on ag lands, farm structure and structures that were used for agricultural live production so that we as lawmakers, policy makers in Delaware and in the counties could understand that rationale,” he said.

During the hearing, Pettyjohn specifically asked Tyler Technologies for the methodologies used to determine the value of farmland in each of the counties.

Michael McFarlane, project manager for Tyler Technologies, said agricultural property is in its own property class, separate from residential or commercial, but he could not speak to specifics on how property values were placed on farmland.

Smyrna-area Sen. Kyra Hoffner continued questioning McFarlane about farmland assessment, quoting Title 9 in state code that says there cannot be discrepancies among counties causing economic disadvantages.

“If we’re having a different valuation on a chicken house in New Castle compared to Sussex County, how is that equal?” she asked.

McFarlane again said he could not answer the specific circumstance, and said the cost approach is used to determine the value of farmland.

Hoffner continued to question how farm structures were valued.

“I’m getting farmers up and down the state that say their valuations are all over the place,” she said. “I found a structure that no one has lived in for 100 years with a tree growing through it, but yet was assessed at $700,000.”

In response, McFarlane said condition and quality are considerations in the improvement analysis, and on-site physical inspections at poultry farms did not happen over concerns of the avian flu.

“If it's the case that a property owner believes their property is overvalued, then the avenue for relief is through the appeal process,” he said.

More meetings are planned, but with two lawsuits now pending against New Castle County property reassessments, the timing will revolve around court action.

Timing of valuation notices questioned

Some legislators questioned the timing of New Castle County’s initial notices of valuation that were sent to residents in mid-November. These notices informed property owners how much their property value was increasing, and gave property owners the opportunity to appeal property information such as number of bedrooms, bathrooms, etc.

Notices to Sussex County residents were also sent in mid-November. Kent County reassessed property a year earlier.

“Everything that was critical to the success of Kent County, and I suspect Sussex County, which is not what happened in New Castle County and it didn’t happen because of a decision to delay it until November, which is the only reason that we're here right now,” said Sen. Eric Buckson, R-Camden-Wyoming. “It was a decision made that has caused this state and New Castle County constituents and residents problems, and has unfairly laid the blame on the existing New Castle County administration.”

Gov. Matt Meyer was the New Castle County executive before his election to governor in early November 2024. He also won a fierce primary battle against Lt. Gov. Bethany Hall-Long in September of that year.

Current New Castle County Executive Marcus Henry testified that it is his administration’s understanding that the New Castle County assessment team recommended several times in 2024 that tentative value notices be mailed to residents over the summer.

“It is also our understanding that the prior administration said no to those recommendations. Instead, the assessment office was advised that tentative value notices couldn’t go out until mid-November,” Henry said.

In a press release sent after the committee hearing, Buckson said, “We learned today that the previous New Castle County administration, led by current Gov. Matt Meyer, chose to delay the issuance of assessment values until November 2024, despite Tyler Technologies’ recommendation to send them out months earlier in July. That decision, which placed the issuance of these notices after the general election, raises important questions that will need to be answered.”

Rep. Michael Smith, R-Pike Creek, said he’d like to see some accountability from Meyer. “I wish he’d show up at some point here,” he said.

In August, Smith had requested Meyer testify during a special session hearing on property assessment bills that were passed.

Melissa Steele is a staff writer covering the state Legislature, government and police. Her newspaper career spans more than 30 years and includes working for the Delaware State News, Burlington County Times, The News Journal, Dover Post and Milford Beacon before coming to the Cape Gazette in 2012. Her work has received numerous awards, most notably a Pulitzer Prize-adjudicated investigative piece, and a runner-up for the MDDC James S. Keat Freedom of Information Award.