Growth, reduced state funding drive March 31 referendum

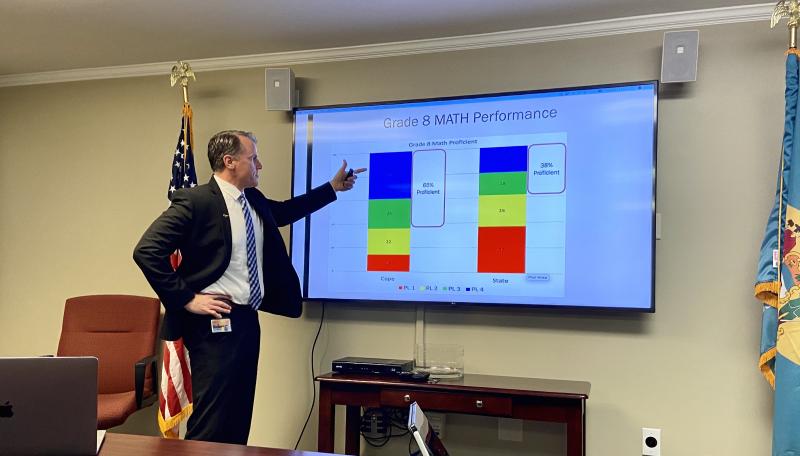

At a Feb. 5 press conference, Cape Superintendent Bob Fulton said more students and less state funding are driving a current expense referendum to generate local revenue.

The proposed 25-cent tax increase per $100 of assessed value would increase the average homeowner’s taxes by $64 a year and generate $3 million for the district.

Fulton said the combined tax rate for debt service, match, tuition and current expense has only gone up $1 since 2013, and since then, $274 million in major capital projects has been approved, paid for by a total $260 increase for the average taxpayer since 2013.

Enrollment has grown from 4,150 students in 2001 to 5,861 students as of January 2020, and studies show enrollment will continue to increase significantly over the next 20 years, Fulton said. Higher student numbers cause increased staffing, utility, curriculum and transportation costs.

Three years ago, Fulton said, the state cut $1.2 million a year in discretionary funding for the Cape district. To address the deficit, district officials made $1.3 million in cuts to personnel and after-school programs, and decreased district office, human resources and superintendent budgets.

Revenue hasn’t grown as hoped, Fulton said, with only moderate assessed property growth. At 3.16 percent of assessed value, revenues are about $734,000 a year. That is good, he said, but not enough. Each year, the district sees an increase of $1 million in staffing and employee benefits, he said.

Concurrently, the state shifted about $400,000 in transportation costs to the district, which also has to pay $470,000 in increased energy costs. Modular classrooms at Beacon and Mariner middle cost the district about $400,000, and, Fulton said, given the area’s growth, additional modulars may be needed before the third middle school is completed, increasing the total cost to about $500,000.

Fulton said the current expense tax rate to operate the district is $1.84; in 2023, it will rise to $1.99 when the new middle school in Lewes opens. If passed, the referendum would increase the rate 25 cents.

At 69 cents, the debt service for the district’s 10 projects is as high as it will go, he said. As debt is retired beginning in 2024, the rate will go down to 67 cents and will continue to go down pennies a year until 2027, when it reduces to 50 cents. By about 2040, the rate zeroes out when bonds are paid off on loans for building construction, Fulton said.

The proposed tax increase will take effect in fiscal year 2021, which begins July 1, 2020. Seniors are eligible for tax relief. Call 302-855-7824 or go to finance.delaware.gov.

Fulton will host community meetings on the referendum at 6 p.m., Wednesday, Feb. 26, at Love Creek Elementary; 6 p.m., Monday, March 9, at Cape High; and 6 p.m., Thursday, March 19, at H.O. Brittingham Elementary.

The referendum is set for Tuesday, March 31. Polls will be open 7 a.m. to 8 p.m. at Cape High, Mariner Middle and Rehoboth Elementary. District residents who are U.S. citizens at least 18 years of age are eligible to vote. Absentee voting is provided through the Department of Elections; call 302-856-5367.